Here is the performance summary:

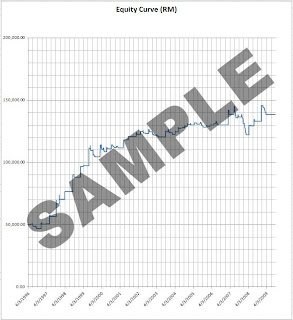

and the equity curve (before cost) chart.

You can see from the report that it is indeed a profitable strategy (although not really impressive) and the equity curve chart is the reverse of the counter-trend chart.

In fact from the performance summary report you can also know the minimum capital needed to sustain the maximum unrealised drawdown and still be able to trade at 100% margin according to the margin of RM5K(just top up whatever amount if you think that the highest possible margin is higher than the one here). It also shows the average annual return if you decide to go with that minimum capital.

I would suggest a much higher capital as it is very hard to stomach a drawdown of over 50% considering you need a return of 100% at that stage just to get back to your starting capital. The usual rule is the percentage of maximum unrealised drawdown over starting capital of not more than 30% as the worst trades will always be ahead of you. Even with all this you can never be certain that you will survive as the future performance is always unknown.

With some simple optimization, I am sure a better parameter with smaller drawdowns and higer system expectancy would be found. Just make sure the sample (in-sample as well as out-sample) data that you test on contain all the different market cycles of bulls, bears and sideways market. You just need to find a trade-off that matches with your own risk appetite.

Disclaimer: Taken from CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER OR OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

AND

WHATEVER YOU READ HERE SHOULD BE USED AS LEARNING AIDS ONLY AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE. IF YOU DECIDE TO INVEST REAL MONEY, ALL TRADING DECISIONS ARE YOUR OWN RESPONSIBILITY.