My brother wants to know the backtest performance summary for EMA 3/30 crossover. Here is the result brother.

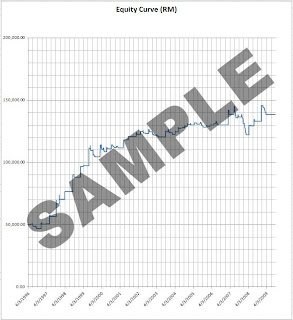

And the equity curve (before cost) chart...

This is a Stop-and-Reverse (SAR) system trading 1 contract on Bursa FKLI (continuous front-month EOD data) from Jan 1996 - Sep 2009. When the EMA 3(closed) crosses above EMA 30 (closed) the system would go Long 1 contract on next-day open and turn Short on next-day open when the EMA 3 (closed) crosses below EMA 30 (closed).

Happy trading brother!

And as usual....

Disclaimer: Taken from CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER OR OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

AND

WHATEVER YOU READ HERE SHOULD BE USED AS LEARNING AIDS ONLY AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE. IF YOU DECIDE TO INVEST REAL MONEY, ALL TRADING DECISIONS ARE YOUR OWN RESPONSIBILITY.

I want to create a 13EMA Cross 34 EMA crossover signal in excel for trading can u plz check if the same on backtesting gives positive return on s&P fut.

ReplyDeleteLong 1tick abv close if 13 EMA cross 34 EMA

Short itick blw If 34 EMA cross 13 EMA

sl 2.5% of Entry

Hi stocktrader, at the moment i am quite busy with my new work, will do that for you and publish the result when i have the time. I am sorry. Cheers & Happy trading!

ReplyDeletecan u suggest me a trading system that help trading and has positive expectancy.

ReplyDeleteStocktrader, after years of developing and testing, I found out that there's no one system that can be used for all products.

ReplyDeleteDifferent product will either need different system or same system but with different parameters and filters added in. Even same system that works in a particular product may not work after some time.

For beginners, I would always suggest them to pickup simple systems such as SMA or volatility based such as BB, or Donchian for both trend-follow or counter-trend trading. Cheers & Happy trading!